Five medium term inflation pressures & implications for investors

Dr Shane Oliver - Head of Investment Strategy and Chief Economist, AMP Capital - 28 November 2022 Key points The surge in inflation should start to reverse next year. However, five structural trends suggest higher medium term inflation pressures than pre-pandemic. These are: a move away from economic rationalist policies; the reversal of globalisation; rising defence spending; [...]

Seven things for investors to keep in mind in rough times like these

Dr Shane Oliver - Head of Investment Strategy and Chief Economist, AMP Capital - 19 October 2022 Key points Share markets remain volatile and at risk of further falls reflecting worries about inflation, aggressive central bank rate hikes, the war in Ukraine and recession fears. Key things for investors to bear in mind are that: share market [...]

Seven key charts for investors to keep an eye on in assessing the investment outlook

Dr Shane Oliver - Head of Investment Strategy and Chief Economist, AMP Capital - 7 September 2022 Key points While we are optimistic on a 12-month horizon, shares are at high risk of further falls and a re-test of their June lows in the short term given hawkish central banks, heightened recession risks and geopolitical risks. Seven [...]

The Rise And Rise of Ali

Our Principal Financial Planner, Anwer Ali Mohammed is featured in The Indian Weekly, one of the prominent Indian Australian weekly magazines. More Article taken from: http://theindianweekly.com.au/the-rise-of-ali/ From a technician in the Indian Air Force to leading sales manager with Apple to being nominated as a rising star among young financial planners in Australia – consider the [...]

Starting A Family

A new baby means surprise, anticipation, awe —and some major financial changes. Exciting times ahead for you Ask any parent, And they’ll agree— the birth of their first child was a life-changer. First you’ve got to get the nursery sorted: crib, furniture, painting and decor. When bub arrives, there are day-to-day costs like nappies and [...]

Managing your money

Budgeting in plain English What is a budget? A budget is a plan that works out how you will manage your income and expenses. Maintaining a budget is a powerful way to control your money. Do you need a budget? A budget allows you to see how much money is coming in and going out. [...]

Changing Jobs

For most of us our job is more than just an income. It is fairly common for us to derive a great deal of satisfaction from our work and our career choices can define who we are and how others perceive us. For that very reason, changing jobs can have a big emotional impact- not [...]

Market Update – November 2020

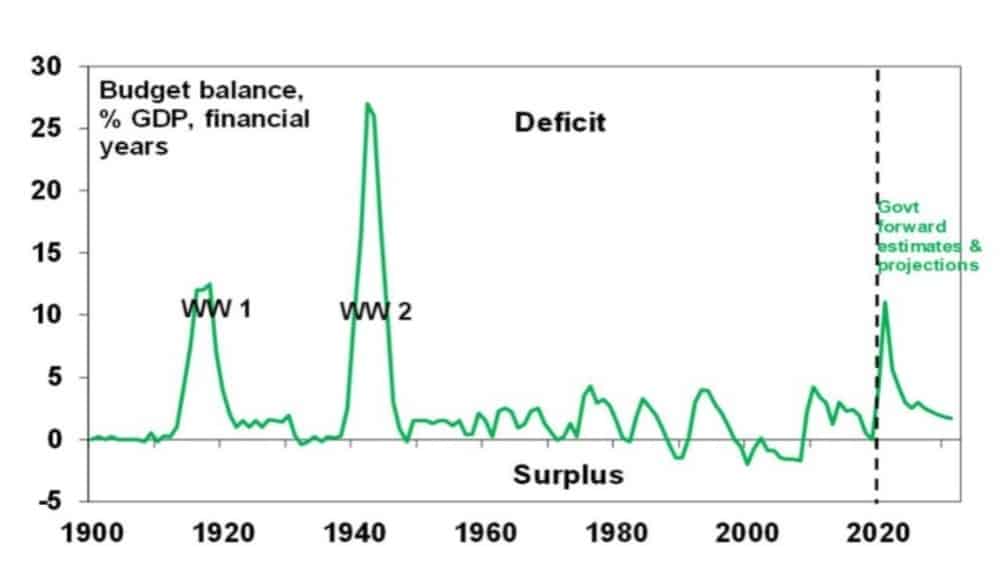

Overview and outlook The Australian budget was released in October and focused on economic recovery by providing more stimulus to boost spending and reduce unemployment. The government expects the budget deficit to peak at $213.7b this financial year (FY21), the highest since the end of WW2. Australian Federal budget deficit Source: RBA, Australian Treasury, AMP [...]

Achieving a comfortable retirement

Many women dream of a retirement where they can kick back and relax, do whatever they like and be free from the demands of others – actually focusing on caring for themselves. But this step often means being free from financial worries or concerns and for a large proportion of women, the prospect of a [...]